|

|||

|

|||

|

|||

|

|

News Article From: 12-03-2010Resale Sales Pricing Analysis

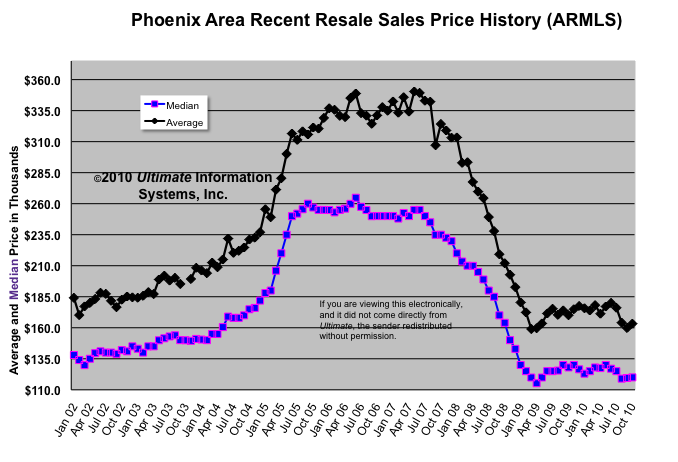

The Median Price in the recently released October ARMLS1 resale sales reports is $120,000, up $500 from the September reports. The Average Price increased from $159,800 to $163,300. The graph below displays both the monthly Average Price and Median Price of resale homes sold in MLS from January 2002 through August 2010.

The average price is calculated by dividing the sum of the sales prices by the number of homes sold. The median price is determined by finding the price where the quantity of homes sold for less than that price is equal to the quantity of homes sold for more than that price. The median is a better indicator of the overall market.

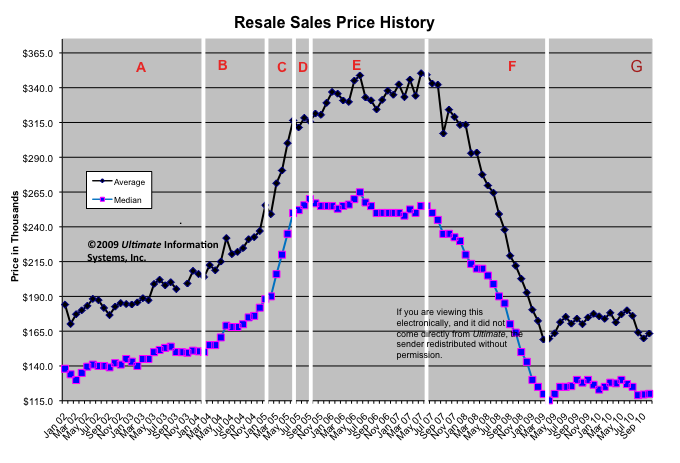

Patterns Emerge When the Time Period is Subdivided

When there is a change in the slope of the line for several consecutive months, it indicates a new pattern is emerging. Five such changes appear on this graph. The display below has been subdivided at each change in slope:

Segmented History

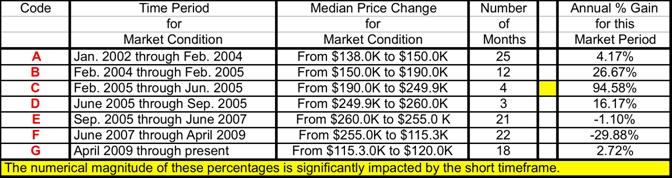

At each change in slope of the lines in the graph above, a shift in trend has taken place. We have identified seven such distinct market conditions (detailed below). Slow steady growth was experienced from 2002 through 2003 and into very early 2004. Then between March 2004 and February 2005, the median home sales price increased by $40,000. In the four months after that a $60,000 increase happened during the hot market of early summer 2005. Starting in July 2005 and lasting through September the market experienced a clear shift back to a more normal appreciation rate. October 2005 was the first month in a period of flat prices and this continued for 21 months through June 2007. July 2007 was the first month in the sixth market condition of rapidly falling median home prices. In July 2009 we reached another turning point of flat prices at the bottom of the market.

The seven market conditions are defined in the following table:

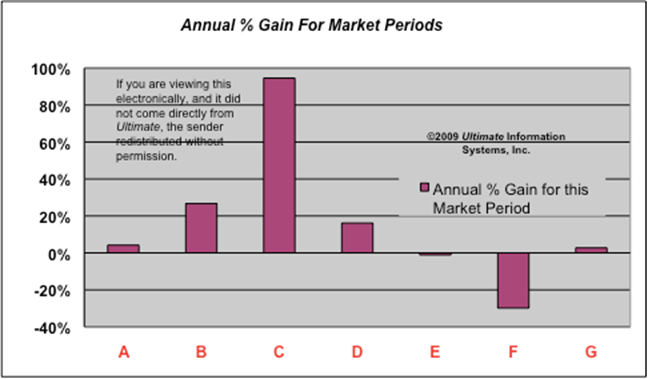

The annual rate of appreciation (listed as “Annual % Gain for this Market Period” in the chart above) is graphically represented below:

Copyright® 2010 - This information is compiled and written by Ultimate Information Systems, Inc. Use of this article, in part or in its entirety, is expressly prohibited without written permission. Click here to request limited rights to reuse this information

1 The Arizona Regional Multiple Listing Service encompasses most of Maricopa and Pinal Counties. |

A CompuGor Website

<!--[endif]-->

<!--[endif]--> <!--[endif]-->

<!--[endif]--> <!--[endif]-->

<!--[endif]--> <!--[endif]-->

<!--[endif]-->